APPLY TODAY

561-594-4545

Our Name says it, we do " All Mortgage Loans "

We are a full-service mortgage company based in Florida.

Whether you are buying a home or refinancing, we can help you realize your dream and save you money.

Purchase Loan Programs, we offer the following:

Conventional | FHA | VA | Jumbo | Commercial | Construction

Less than Perfect Credit | Bank Statements | Stated Income | Self-Employed | Investor

Re-Finance Programs designed to meet your needs, we offer the following:

CashOut | Shorten Terms | Lower Rate | Home Improvement

Contact All Mortgage Loans today to discuss your mortgage options and find out which program will best suit your needs.

About Us

We've been helping customers afford the home of their dreams for many years and we love what we do.

Company NMLS: 1588734

Social

How does the Mortgage Loan Originator impact my Rates and Fees as a Consumer looking to Refi or Purchase a home ?

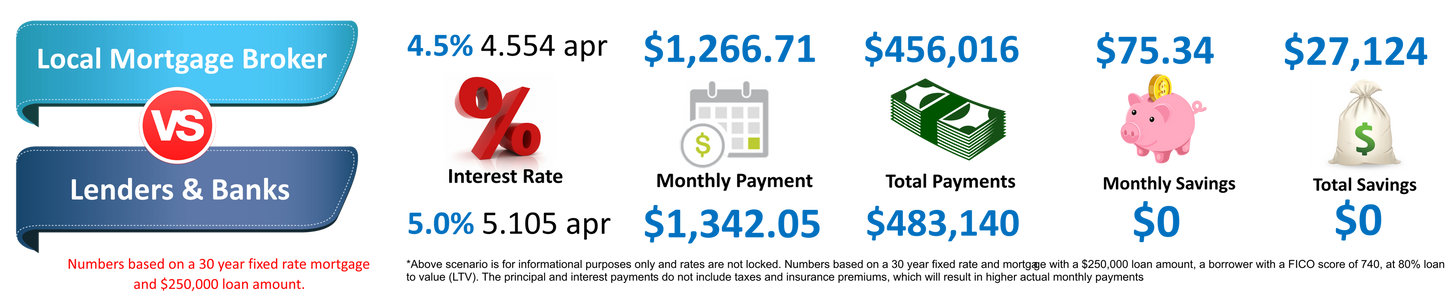

Mortgage Brokers work for YOU ! Mortgage Bankers work for one lender - No Choices at all !

SHOPPING for a MORTGAGE CAN REALLY PAYOFF !

COMPARING Lenders can SAVE YOU THOUSANDS !

WE ARE HERE TO HELP YOU SHOP FOR THE BEST RATE !

What documents do I need to prepare for my loan application?

Below is a list of documents that are required when you apply for a mortgage. However, every situation is unique and you may be required to provide additional documentation. So, if you are asked for more information, be cooperative and provide the information requested as soon as possible. It will help speed up the application process.

Your Property

Copy of signed sales contract including all riders, Verification of the deposit you placed on the home

Names, addresses and telephone numbers of all realtors, builders, insurance agents and attorneys involved

Copy of Listing Sheet and legal description if available (if the property is a condominium please provide condominium declaration, by-laws and most recent budget)

Your Income

Copies of your pay-stubs for the most recent 30-day period and year-to-date, Copies of your W-2 forms for the past two years, Names and addresses of all employers for the last two years

Letter explaining any gaps in employment in the past 2 years, Work visa or green card (copy front & back)

If self-employed or receive commission or bonus, interest/dividends, or rental income:

Provide full tax returns for the last two years PLUS year-to-date Profit and Loss statement (please provide complete tax return including attached schedules and statements. If you have filed an extension, please supply a copy of the extension.), K-1's for all partnerships and S-Corporations for the last two years (please double-check your return. Most K-1's are not attached to the 1040.)

Completed and signed Federal Partnership (1065) and/or Corporate Income Tax Returns (1120) including all schedules, statements and addenda for the last two years. (Required only if your ownership position is 25% or greater.)

If you will use Alimony or Child Support to qualify:

Provide divorce decree/court order stating amount, as well as, proof of receipt of funds for last year, If you receive Social Security income, Disability or VA benefits:

Provide award letter from agency or organization

Source of Funds and Down Payment

Sale of your existing home - provide a copy of the signed sales contract on your current residence and statement or listing agreement if unsold (at closing, you must also provide a settlement/Closing Statement)

Savings, checking or money market funds - provide copies of bank statements for the last 3 months, Stocks and bonds - provide copies of your statement from your broker or copies of certificates

Gifts - If part of your cash to close, provide Gift Affidavit and proof of receipt of funds, Based on information appearing on your application and/or your credit report, you may be required to submit additional documentation

Debt or Obligations

Prepare a list of all names, balances, and monthly payments for all current debts

Include all names, addresses, account numbers, balances, and monthly payments for mortgage holders and/or landlords for the last two years

If you are paying alimony or child support, include marital settlement/court order stating the terms of the obligation

Frequently asked Questions:

When should I refinance?

It's generally a good time to refinance when mortgage rates are 2% lower than the current rate on your loan. It may be a viable option even if the interest rate difference is only 1% or less. Any reduction can trim your monthly mortgage payments. Example: Your payment, excluding taxes and insurance, would be about $770 on a $100,000 loan at 8.5%; if the rate were lowered to 7.5%, your payment would then be $700, now you're saving $70 per month. Your savings depends on your income, budget, loan amount, and interest rate changes. Your trusted lender can help you calculate your options.

What are points?

A point is a percentage of the loan amount, or 1-point = 1% of the loan, so one point on a $100,000 loan is $1,000. Points are costs that need to be paid to a lender to get mortgage financing under specified terms. Discount points are fees used to lower the interest rate on a mortgage loan by paying some of this interest up-front. Lenders may refer to costs in terms of basic points in hundredths of a percent, 100 basis points = 1 point, or 1% of the loan amount.

Should I pay points to lower my interest rate?

Yes, if you plan to stay in the property for a least a few years. Paying discount points to lower the loan's interest rate is a good way to lower your required monthly loan payment, and possibly increase the loan amount that you can afford to borrow. However, if you plan to stay in the property for only a year or two, your monthly savings may not be enough to recoup the cost of the discount points that you paid up-front.

What does it mean to lock the interest rate?

Mortgage rates can change from the day you apply for a loan to the day you close the transaction. If interest rates rise sharply during the application process it can increase the borrower’s mortgage payment unexpectedly. Therefore, a lender can allow the borrower to "lock-in" the loan’s interest rate guaranteeing that rate for a specified time period, often 30-60 days, sometimes for a fee.What is an appraisal?

An Appraisal is an estimate of a property's fair market value. It's a document generally required (depending on the loan program) by a lender before loan approval to ensure that the mortgage loan amount is not more than the value of the property. The Appraisal is performed by an "Appraiser" typically a state-licensed professional who is trained to render expert opinions concerning property values, its location, amenities, and physical conditions.

What is PMI (Private Mortgage Insurance)?

On a conventional mortgage, when your down payment is less than 20% of the purchase price of the home mortgage lenders usually require you get Private Mortgage Insurance (PMI) to protect them in case you default on your mortgage. Sometimes you may need to pay up to 1-year's worth of PMI premiums at closing which can cost several hundred dollars. The best way to avoid this extra expense is to make a 20% down payment, or ask about other loan program options.

MISSION STATEMENT

We at All Mortgage Loans, know who we represent, our customers/clients and not the bank.

With that in mind, we work with you as if you are family. Not content with a job done, but as a job well done.

Exceeding expectations is the goal and our standard. Aggressively maintaining the highest standards in the

industry, but also maintaining a high moral code as well. We strive to attain all the goals of our borrower, by providing the best interest rates in the market. You can rely on All Mortgage Loans will be there for you...

About Us

Paul Hartz, Broker/Owner brings 29 years of experience to his craft. A Worcester, MA native, he moved his soon to be family to Vero Beach Florida to begin a new chapter and have plenty of sunshine too . Having worked in large mortgage corporations and to everything small and in between, Today, he can do ANY loan you may need.

His self proclaimed "purpose in life " was to be a Dad. While the boys were growing up, Paul was very active in their sports lifestyle, His oldest a Cal Ripken World Champion with the Jupiter All-Stars. His youngest an accomplished football and rugby player. He was active in the community and focused on helping the children. Today his focus is on homelessness in children and Veterans. His passions drive his day and keep him focused.

Often quoted when he had a 2 hour radio and 30 min TV show "Planning for the Future" , its real estate he believes in. Owning a home is the American Dream , a path to wealth and available to all who want it. He represents his clients and works hard to not only get the job done, but done well. It is this passion that coined the phrase " If Paul can't do it, it simply cannot be done" .

All Mortgage Loans is versed in all conventional loans ( FHA, VA, Fannie etc ) and the "outside the box" loans, such as self-employed, bank statements in lieu of tax records, less than perfect credit score, stated income, investment fix and flip loans. If you are building a home, then the construction and construction perm loans are a particular expertise.

Today he does not regret the path he designed to be in law enforcement did not work out, because he gets to serve in this capacity. Working viturally, you might not get to meet face to face, but our Clients are still family. Paul is your mortgage man for life.

Years of experience

Million loans funded

What our clients say about us

Paul did an excellent job with our condo loan requiring quick turn around. He helped us solve

some issues and got it done to close on time. Highly recommend!

I have never have been so pleased with a mortgage broker before.

Paul explained everything to me every step of the way. Was always available for any questions.

From the beginning to end him and his team are amazing. I definitely recommend him. If Paul can’t do it no one can.

If you are a self employed person and/or own your own

small business and can't get a loan. You have to call Paul - He will help you make it happen

Paul Hartz will help you make your home refinancing dreams come true with a deal that no other can beat he puts his heart and soul into getting you what you want and need to make your dreams possible.

Challenge him to make your refinancing dreams come true,lower intrest rate, home improvement, consolidate debt one or all of these are possible,

You will never find someone who will work harder at making your dreams come true.

Signed a very satisfied customer.

If you are looking to purchase a home or refinance Paul is your man! He is fast, efficient, friendly and can get you the best rates available.

Great place to get a home loan or a refinance. I did both through this company. They get the job done!

Legal Disclaimer

We hereby authorize you to view and print information on this website subject to it being used for informational and non-commercial purposes.

The information contained in this website is believed to be reliable, but we do not warrant its completeness, timeliness or accuracy. The information on this website is not intended as an offer or solicitation for any mortgage product or any financial instrument. The information and materials contained in this website - and the terms and conditions of the access to and use of such information and materials - are subject to change without notice. Products and services described may differ among geographic locations, offices and as a result of individual conditions. Not all products and services are offered at all locations. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

It is our intention that data provided on a subject is of a general nature. Our website does not represent an exhaustive treatment of subjects nor is the information intended to constitute accounting, tax, legal, consulting or other professional advice.

Prior to making any decision or taking any action we kindly request you to contact your tax or legal advisors.

Please use this document and information at your own risk. The content of this site is copyrighted and therefore any unauthorized use of any materials on this website may violate copyright, trademark, and other laws.

Materials on this website may not be modified, reproduced, or publicly displayed, distributed or performed for any public or commercial purposes prior to our approval.

PRIVACY POLICY

Customer service is very important to all of us. As we continue to improve and expand our services, we recognize our customers' need and desire to preserve their privacy and confidentiality. Safeguarding our customers' privacy is also very important to us. We have adopted standards that help maintain and preserve the confidentiality of customers' nonpublic personal information. The following Statement affirms our continued efforts to safeguard customer information.

Information We Collect

We gather nonpublic personal information about our customers as may be necessary to conduct business with our customers.We collect nonpublic personal information about you from the following sources:

- Information we receive from you on applications or other forms, over the telephone or in face-to-face meetings, and via the Internet. Examples of information we receive from you include your name, address, telephone number, social security number, credit history and other financial information.

- Information about your transactions with us or others. Examples of information relating to your transactions include payment histories, account balances and account activity.

- Information we receive from a consumer reporting agency. Examples of information from consumer reporting agencies include your credit score, credit reports and other information relating to your creditworthiness.

- From employers and others to verify information you have given to us. Examples of information provided by employers and others include verifications of employment, income or deposits.

Information We Disclose

Your personal information will only be retained for the purpose of providing you with our response to your query and will not be made available to any third party except as necessary to be disclosed to any related entity for the purpose intended or as required to be disclosed under law.

By submitting data on our website, the visitor is providing explicit consent to transmission of data collected on the website.

We treat data as confidential within our firm and require a strict adherence of all our employees to data protection and our confidentiality policies.

All visitors, however, should be aware that our website may contain links to other sites that are not governed by this or any other privacy statement.

We reserve the right to amend (that is, add to, delete or change) the terms of this Privacy Statement from time to time.